north dakota sales tax on vehicles

Gross receipts tax is applied to sales of. A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers.

The Dealer Handbook contains laws and policies pertaining to vehicle sales.

. You will also need to pay a 5 title transfer fee 5 sales tax. This includes the following see. There is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use on the streets and highways of this state and required.

The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2. You can find these fees further down on the page. Sales Tax Exemptions in North Dakota.

Related

- good zombie movies on netflix 2021

- jason statham movies on netflix uk

- spilled coffee on laptop still works

- frederick douglass quotes on reconstruction

- movies like nicholas sparks on netflix

- sheryl sandberg quotes on leadership

- west end auto sales

- tacoma sales tax rate 2021

- swift tax service washington dc

- how do you change the background color on instagram story repost

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Or the following vehicle information.

This page discusses various sales tax exemptions in North Dakota. When you buy a car in North Dakota be sure to apply for a new registration within 5 days. To schedule an appointment please call 1-844-545-5640.

North Dakota has recent rate changes Thu Jul 01 2021. SDL 32-5-2 are also exempt from sales tax. That state we would require proof of tax paid to exempt you from North Dakota excise tax.

North Dakota has 126 special sales tax jurisdictions with local sales taxes in addition to the state. Groceries are exempt from the North Dakota sales tax. With local taxes the total sales tax rate is between 5000 and 8500.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Recreational travel trailers purchased for use in north dakota are required to be registered with the department of transportation and the purchase price is subject to 5 percent.

Improvements to Commercial and Residential Buildings. Property Tax Credits for North Dakota Homeowners and Renters. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

Qualifying Veterans and Disabled Persons Confined. 5 Sales Tax The North Dakota 5 sales tax applies on the rental charges of any licensed motor vehicle including every trailer or semi. The statewide sales tax in North Dakota is 5 and.

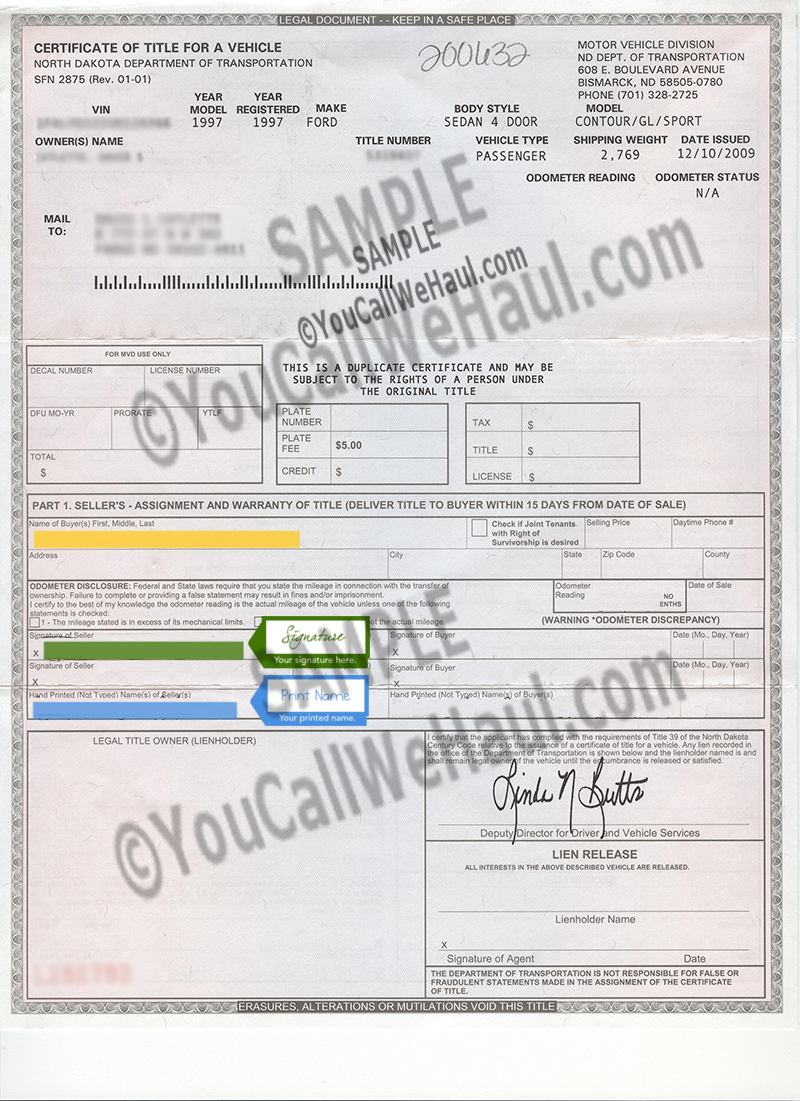

The state sales tax rate in North Dakota is 5000. How to complete a North Dakota Motor Vehicle Title. Select the North Dakota city from the list of popular cities below to see its current sales tax rate.

If the vehicle was purchased outside of the United States there is no tax reciprocity. Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. Motor vehicles exempt from the motor vehicle excise tax under.

2290 IRS Filing Requirements. Homestead Credit for Special Assessments. Local sales tax collections are.

The 5 sales tax and the 3 rental surcharge are separate charges with each applying to the rental charges and are in addition to motor vehicle excise tax paid on the vehicle purchase price. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 374 rows North Dakota Sales Tax.

The gross receipts from sales of motor vehicles required to be titled under North Dakota Century Code ch. Taxes would be due on the purchase price based on exchange at a rate of 5. In North Dakota there are 3 types of motor fuel tax.

Sales tax was imposed on all vehicle rentals of less than 30 days at a rate of 5 and an additional 3 surcharge was imposed on vehicles weighing less than ten thousand pounds. Property Tax Credit for Disabled Veterans. This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax.

The rate of penalty applied to delinquent sales tax returns was changed to. Heavy Vehicle Use Tax. While the North Dakota sales tax of 5 applies to most transactions there are certain items that may be exempt from taxation.

Property Exempt From Taxation. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. North Dakota Gas Tax.

North Dakota imposes a sales tax on retail sales. The north dakota 5 percent sales tax applies on the rental charges of any licensed motor vehicle including every trailer or semi trailer as defi ned in ndcc. IRS Trucking Tax Center.

The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on top of the state tax. The sales tax is paid by the purchaser and collected by the seller.

The motor vehicle excise tax must be paid to the North Dakota department of transportations motor vehicle division when application is made for registration plates or for a certificate of title for a motor vehicle. North Dakota Title Number. The sales tax is paid by the purchaser and collected by the seller.

With local taxes the total sales tax rate is between 5000 and 8500. Farm Buildings and Other Improvements. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax.

In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees. Year first registered of the vehicle this will be within one year of the model Shipping or gross weight of the new vehicle required depending on the type of vehicle. Average Sales Tax With Local.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. To calculate registration fees online you must have the following information for your vehicle. Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor.

North Dakota sales tax is comprised of 2 parts.

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

Nj Car Sales Tax Everything You Need To Know

North Dakota State Vehicle Title Transfer Guide Sell My Car Now

Car Sales Tax In North Dakota Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

Pin On The Cars I Ve Owned It Makes No Sense

What S The Car Sales Tax In Each State Find The Best Car Price

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

Pin On Form Sd Vehicle Title Transfer

Free North Dakota Motor Vehicle Dmv Bill Of Sale Form Pdf

North Dakota Vehicle Title Donation Questions

Why Choose Enclosed Auto Transport Transportation Vehicle Shipping Transport Companies

Pin On Wheels And Deals At Sioux Falls Ford

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes

North Dakota Vehicle Donation Title Questions Vehicles For Veterans

The Oldie Dodge Ram Sport In Fire Red What A Turn On Hahaha Afiches Publicidad

Klassen Mercedes Sprinter Custom Auto

North Dakota 2017 Passenger Issue In Late 2015 North Dakota Embarked On Their First General Plate Reissue Since 1993 Introdu Car Plates Plates License Plate